Business Asia, September 10, 2025 – PT Edena Capital Nusantara of EDENA Group today confirmed the accelerated deployment of Egypt’s first Security Token Offering (STO) exchange following a strategic visit by Egypt’s Bayt El Khebra Group (BEK Group) leadership to Seoul. The high-profile delegation traveled to Korea specifically to advance partnership implementation, confirming Q4 2025 launch with potential acceleration to Q1 2026.

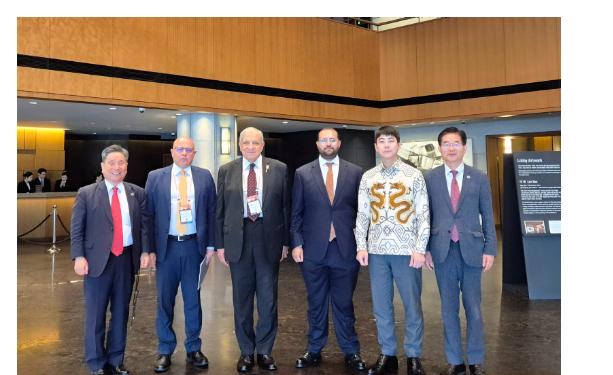

The Egyptian delegation was led by former Prime Minister Ibrahim Mahlab (BEK Group Executive Director), accompanied by Mohamed Khaled Abdallah (BEK Vice Chairman) and Mohamed El-Sebely (CEO BEK Financial). They met with EDENA leadership including CEO Wook Lee and directors Sanghyun Lee, Yoo Sun Hwan, and Kang Woong Sik. The presence of Khaled Abdel Rahman, Ambassador of Egypt to Korea, underscored the strategic importance at governmental levels.

Partnership with Egypt’s Most Powerful Financial Group

Bayt El Khebra Group (BEK Group), established in 1949, stands as one of Egypt’s largest and most influential financial services conglomerates. With operations spanning investment banking, infrastructure development, and real estate projects valued at hundreds of billions, BEK has shaped Egypt’s modern economy. Under the leadership of former PM Ibrahim Mahlab—who served as Egypt’s 35th Prime Minister and previously led Arab Contractors through mega-projects including the Suez Canal expansion—BEK maintains direct access to presidential advisory circles and regional government networks across 70 countries.

“The partnership with BEK Group elevates EDENA to unprecedented heights in global digital securities,” stated Wook Lee, CEO of EDENA Group. “Our proven expertise in carbon markets, digital finance innovation, and multi-jurisdictional operations, combined with BEK’s unmatched regional influence, positions us to lead the transformation of emerging market finance.”

Twin Pillars: Real Estate and Carbon Credits

The Seoul meetings confirmed an ambitious dual-asset strategy. While real estate tokenization remains the primary focus with a $250 million Cairo development already secured, Egypt’s growing emphasis on carbon credits through recent Financial Regulatory Authority initiatives positions environmental assets as a co-primary offering.

“Egypt is strategically positioned to become Africa’s carbon credit powerhouse while maintaining its real estate dominance,” noted former PM Mahlab during discussions. “Our STO platform will tokenize both premium real estate and carbon credits, creating unprecedented investment opportunities for global markets while supporting Egypt’s economic and environmental objectives.”

Mohamed El-Sebely added, “The Egyptian government’s recent focus on voluntary carbon markets aligns perfectly with EDENA’s expertise in environmental asset tokenization.”

Game-Changing Impact for Indonesian Operations

For PT Edena Capital Nusantara’s upcoming Indonesian launch, the Egypt partnership delivers transformative advantages:

- Institutional Validation: Direct association with former PM Mahlab and Egypt’s premier financial group strengthens credibility with Indonesian regulators and investors

- Diversified Asset Base: Egyptian real estate and carbon credits complement Indonesian offerings, creating a truly global marketplace

- 24/7 Trading Network: Cairo-Jakarta corridor enables round-the-clock liquidity across time zones

- Market Leadership: Combined reach of 2.5 billion people across 70+ countries positions EDENA as the dominant emerging market platform

Strategic Growth Trajectory

The partnership targets expansion based on market demand:

- 2025-2026: $10 billion in tokenized assets (real estate, infrastructure, carbon credits)

- 2026-2027: $50 billion transaction volume

- 2027: $100 billion assets under management

- 2028-2030: Expansion to 20+ African nations

“These projections reflect realistic growth based on our existing pipeline and regulatory approvals,” emphasized Sanghyun Lee, Director of EDENA Group. “As the primary regulated gateway connecting ASEAN and MENA markets, we’re positioned for significant but sustainable growth.”

Strategic Advantages

The EDENA-BEK alliance leverages unique competitive advantages:

- Egypt’s strategic position controlling 12% of global trade through the Suez Canal

- BEK’s 76-year institutional relationships across Middle East and Africa

- EDENA’s operational excellence across multiple regulatory jurisdictions

- Combined government support from Cairo to Jakarta

Implementation Timeline

- July 2025: Strategic partnership with BEK Group established

- September 2025: Seoul meeting to finalize operational details (current)

- Q4 2025: Soft launch with institutional investors

- Q1 2026: Full public launch

- 2026-2027: Expansion across MENA region with BEK’s network

“This partnership transcends traditional financial ventures,” concluded Wook Lee. “We’re building the infrastructure for South-South cooperation, enabling direct capital flows between emerging markets without Western intermediation.”

About EDENA Group

EDENA Group operates digital securities exchanges across multiple jurisdictions, developing government-approved platforms for tokenizing real assets including real estate, carbon credits, and infrastructure projects. The group enables minimum investments from $10 and 24/7 trading capabilities, with operations expanding across ASEAN and MENA regions.

About Bayt El Khebra Group (BEK Group)

Founded in 1949, Bayt El Khebra Group represents Egypt’s premier financial services conglomerate. Under the leadership of former Prime Minister Ibrahim Mahlab as Executive Director, BEK has been instrumental in Egypt’s landmark projects including the Suez Canal expansion, the New Administrative Capital, and major infrastructure developments across the region.